This Apple stock predictions for 2020 article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

This Apple stock predictions for 2020 article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- The stock price of Apple is now more than 18% higher than it was during my September 19 buy recommendation.

- I am still endorsing AAPL as a reasonable value play investment. My 90-day price target for AAPL is $290.

- Apple will get a decent tailwind from Black Friday and Christmas shopping sales events. Entry-level iPhones are still more attractive than flagship Android phones.

- The Second tailwind is the release of the new MacBook Pro. It should help Apple sell more than 5.3 million Mac computers this last quarter of 2019.

- Stronger iOS hardware sales also increase the growth of Apple’s $12.5 billion quarterly revenue from its Services segment.

My September 19 buy recommendation for Apple (AAPL) was a grand slam bet. AAPL’s price since that day has since shot up more than 18%. From trading below $223 two months ago, AAPL has since shot up above $260. AAPL even posted a new 52-week high of $268 last November 19. I am still endorsing this stock as a buy. I am giving it a new 90-day price target of $290. The global reach of Christmas shopping/Black Friday/CyberMonday sales events is a near-term tailwind for Apple.

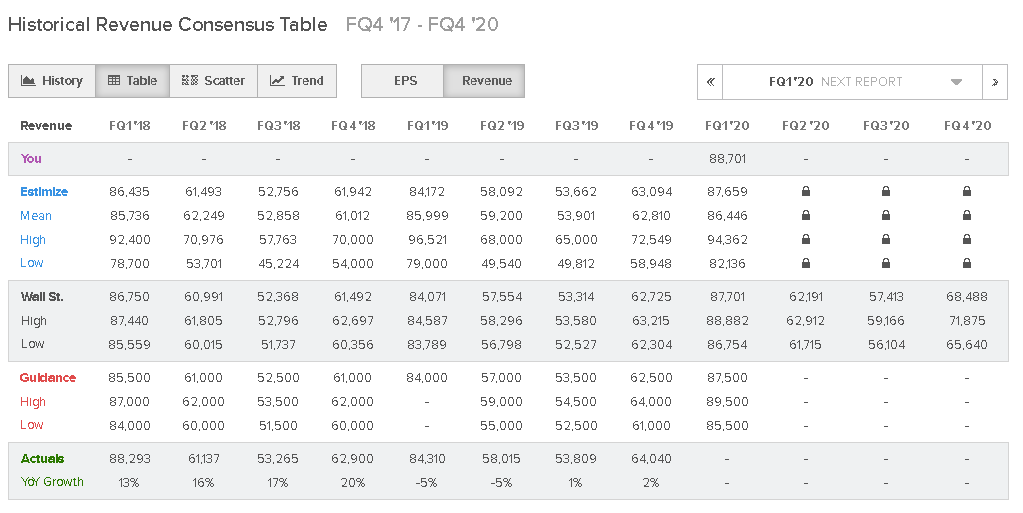

Management’s guidance for Apple’s December quarter (or Q1 FY 20) revenue is $85.50 to $89.50 billion. However, it is logical to expect that hundreds of millions of people will have stronger purchasing power during November and December. These are the months wherein employees get their 13th month pay and Christmas bonuses. Apple’s Q1 FY 2020 topline will benefit from holiday retail sales, which already exceeded $1 trillion in 2018. U.S. households spent an average of $1,536 during the holidays last year. Apple’s December quarter could therefore generate revenue of $90 billion or higher.

I am not the only one who thinks Apple can deliver Q1 revenue of $90 billion. Investment bank Cowen also believes the same. Cowen proposed that 0% interest iPhone promotions and price cuts to the iPhone XR and cheaper iPhone 11 would help Apple ship 69 million iPhones in the first quarter.

Historically, the first quarter is Apple’s most lucrative period. Cheaper iOS devices during Christmas can help Apple post a new record for Q1 FY20 revenue.

There was a decline in Q1 FY20 largely because of China. The China problem persists due to the unresolved trade war between the U.S. and China. However, other markets like India, Japan, and Europe can make up for the weak iPhone demand in China.

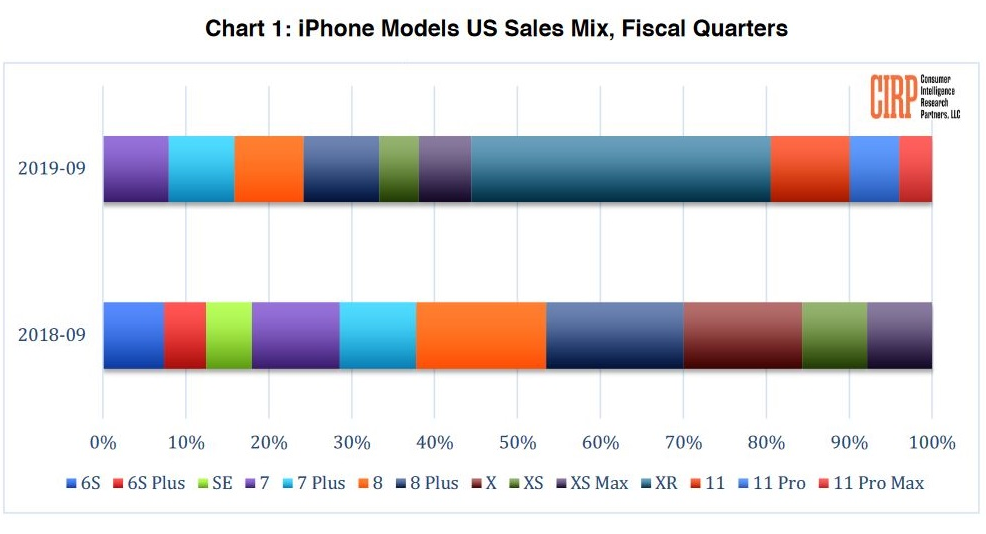

The lower price tags for the iPhone 11 is a long-term tailwind for AAPL. Entry-level phones accounted for almost 50% of U.S. iPhone sales in Apple’s Q4 FY2019. The chart below illustrates Q4 iPhone sales by models. The iPhone XR accounted for 36% of U.S. iPhone sales. In spite of being available for only two weeks, the new iPhone 11, iPhone 11 Pro and Pro Max accounted for 20% of Q4 iPhone Sales.

Making more iPhones affordable increases their total addressable market. Potential customers in India, Asia, and Latin America will likely consider the iPhone 11 as an alternative to flagship Android phones from Oppo, Vivo, and Xiaomi.

Cheaper new iPhones also encourages wireless companies to subsidize them again to attract new postpaid customers. It is more compelling for corporate purchase managers (and ordinary buyers) to buy postpaid iPhone 11 phones if a telco offers reasonable subsidized price tags. A more robust subsidized iPhone packages from tier 1 telcos can help Apple ship/sell more than 70 million iPhones in Q1.

The probable release of the budget-friendly 4.7-inch iPhone SE 2 next year is tailwind for iPhone sales. If the SE 2 again retails for less than $400, it is reasonable to expect Apple to sell 100 million of it during its first year of availability.

Stronger Mac Sales In Q1

The recent release of the new 16-inch MacBook Pro laptop could help Apple improve its PC sales during this last quarter of the year. IDC’s Q3 2019 (July to September) global PC shipments report showed a year-over-growth of 0.8%. However, Apple’s PC shipment volume was -6.1% year-over-year in Q3 2019. The latest 16-inch MacBook Pro with the lowest configured Radeon RX 5300 GPU is already a certified PC gaming machine.

I’m bullish on Mac sales because there’s now a MacBook that can equal the best Windows gaming laptops. Gaming notebooks/laptop shipments/sales are growing faster than gaming desktop PCs. The chart below shows gaming laptops will enjoy 8.4% CAGR until 2023. This is notably higher than desktop gaming PCs’ 1.8% CAGR.

I also expect the Christmas holiday shopping boost to help Apple achieve Mac revenue of $7.5 billion in Q1 FY20.

The PC gaming hardware market is a growing opportunity for Apple. DFC Intelligence projected that the PC gaming hardware industry will see $70 billion in global spending by 2023. This notably greater than 2018’s spending of $44 billion.

Greater implementation of iOS app compatibility on MacOS Catalina should encourage more people to upgrade their old MacBooks, iMacs and Mac Minis. As per my experience, MacOS computers older than 2014 are not optimized for Catalina.

Services Segment Growth Is Influenced By Hardware Sales

The iPhones, iPads, Mac computers, and watch it sells, the better it is for Apple’s fast-growing Services segment. From less than $3.7 billion in Q1 2013, the Services segment ended Q4FY19 with $12.51 billion. Better hardware sales ultimately lead to more potential subscribers to Apple Books, Apple Music, Apple TV+, Apple News, and Apple Arcade.

The Services segment’s rapid growth over the last 5 years is due to Apple dominating smartphone/tablet/smartwatch sales charts since 2013. All the subscription-based services of Apple can only recruit customers from people who actually own iOS or MacOS devices. Going forward, hardware sales performance will still influence just how fast Apple TV+ and Apple Arcade can grow.

Sub-$400 iPhones, $299 iPads, and $99 Apple TV boxes ultimately leads to more long-term subscription customers for Apple services. My 90-day $290 price target for AAPL is feasible. All Apple have to do is to announce $13 to $14 billion in Q1 FY20 revenue for its Services segment. Subscription services’ performance, not only iPhone sales, can apparently boost the stock price.

Conclusion

The consensus 12-month forward P/E estimate for AAPL is only 19.88. This is still an undervaluation in my book. Apple’s dominant leadership in high-end smartphones, PCs, wearables, and computers will eventually convince more investors to elevate AAPL to 23x forward P/E valuation. This valuation is still lower than Microsoft’s (MSFT) forward P/E of 27.40x. Both companies are into hardware and paid subscriptions. APPL does not deserve a valuation that is notably lower than that of its peers.

If Apple can end its FY 2020 with EPS of $13.50, its stock could trade as high as $310.5 by October/November 2020. Going long on AAPL while it trades below $265 is a judicious bet. I Know First has a very bullish buy signal for AAPL. This is based on AAPL’s latest one-year algorithmic market trend forecast score of 242.90.

Past Success With Apple Stock Predictions

I Know First has been bullish on Apple stock price in past predictions. On July 28, 2019, the I Know First algorithm issued a bullish forecast for Apple’ shares. The algorithm successfully forecasted the movement of the AAPL price. Until today, Apple stock price have risen by 26.01% in line with the I Know First algorithm’s stock forecast. See chart below.

This bullish Apple stock forecast was sent to the current I Know First subscribers on July 28, 2019.

Here at I Know First, one of the top fintech companies in the industry, our algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily forecasts, currency forecast, gold predictions, world indices, as S&P 500, and, in particular, Apple stock forecast. Additionally, we provide the latest Apple stock news ,updates and the latest launches. Today, we are producing daily forecasts for over 10,500 assets. This stock market forecast generated by our algorithmic trading tool is used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.