Apple Stock News: Apple and Amazon Join Forces in Lucrative New Partnership

Apple Stock Price Analysis: New Partnership With Amazon Is A Boon For Apple

Summary:

- This holiday quarter should see a notable increase in Apple’s hardware sales. Apple’s flat lining iPhone unit sales desperately needs a boost.

- Amazon recently agreed to sell Apple Watches, iPhones, and iPad tablets in its U.S. and international online stores.

- Amazon agreed to become an official Apple reseller. Amazon will delist unauthorized resellers of Apple products using its platform by January 4, 2019.

- Amazon touts more than 100 million Prime subscribers. They are all desirable potential customers for Apple products. Buying online is faster than queuing up at an Apple retail store.

- I still rate AAPL as a buy.

The $750 iPhone XR is reportedly not selling as well as expected. Based on Apple’s latest earnings report, iPhone unit sales is flat. Global sales of tablets is also shrinking. It is therefore a great relief to learn that Apple successfully persuaded Amazon (AMZN) to sell iPhones and iPads in America and other countries.

Amazon is the third-ranked vendor of tablets with its Fire Android products. It pleases me that Amazon agreed to be a direct reseller of iPads.

Why Apple Needs Amazon

I previously harped about it many times – AAPL’s price movement is largely dictated by how many units of iPhones it sold. AAPL dipped post-earnings last November 2 because investors are scared that iPhone sales have peaked. The management’s decision to no longer report unit sales of iPhones going forward is worrisome for some investors. It was perceived as tacit admission that iPhone unit sales has really peaked. The mood now is that Apple can no longer rely on the iPhone for growth.

Apple Unveils Highly Anticipated New Line Up at October Event

Apple Unveils Highly Anticipated New Line Up at October Event (Flickr) After a long period of anticipation, Apple has held its October event in Brooklyn

Apple Inc. Is Still The Big Bad Bull

“There Is More In The Making” (Flickr) The first company to hit a trillion dollar valuation continues to refine their strategies and will continue to

Apple Stock Forecast: AAPL May Be Headed Towards Another Record Quarter

Apple Stock Forecast: High Demand For XS Max, XR On The Way (By Rhaym tech Via Wikimedia Commons) With the release of the new iPhone

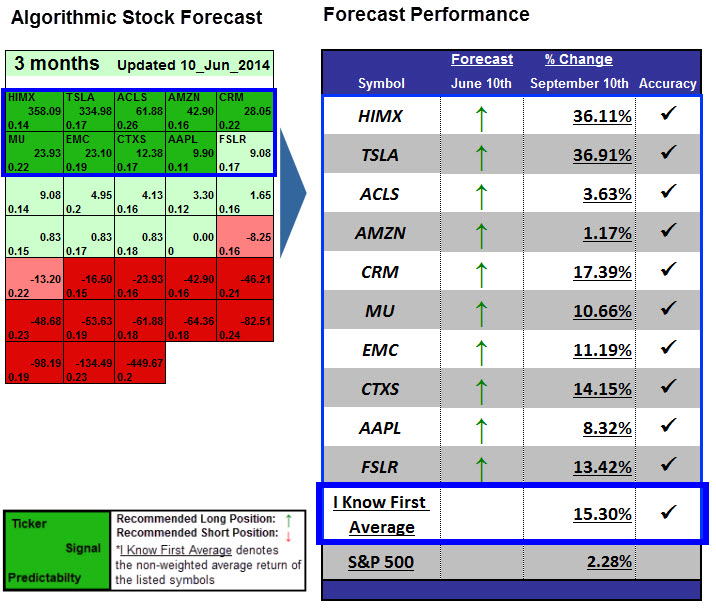

Apple Stock Predictions: 8.32% Gain in 3 months

Package Name: Tech Stocks

Recommended Positions: Long Forecast Length: 3 Months (6/10/14 – 9/10/14)

Forecast Length: 3 Months (6/10/14 – 9/10/14)

I Know First Average: 15.30%

Get the “Top Tech Stocks” Package.