Apple Stock Forecast

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Warren Buffet’s revelation that his Berkshire Hathaway bought 75 million more Apple shares in Q1 boosted the stock beyond my 12-month price target of $188.

- I was correct to say that the $100 billion stock repurchase program was a strong incentive for long-term investors like Buffett to fall in love more with Apple.

- I would like to discuss now the importance of updating the other products of Apple. Apple needs to take care of its loyal horde of Mac Mini and iPad Mini customers.

- The availability of Intel’s Kaby Lake-G Core i7 and Core i5 with on-package AMD Radeon RX Vega M should compel Apple to produce an upgrade to the 2014-era Mac Mini.

- The iPad Mini 4 is also almost three years old. It deserves a 2018/2019 version. The 8-inch form factor of the iPad Mini makes it a comfortable gaming device.

Apple (AAPL) has already delivered my previous 12-month price target of $188. It is justified to do some profit-taking now. The reason for AAPL’s quick rise to above $188 is due to Warren Buffett’s May 3 evening revelation that his Berkshire Hathaway team bought 75 million more Apple shares in Q1 2018. Buffett raising his bet on Apple obviously inspired institutional investors and hedge fund managers.

AAPL’s closing price rose from $176.21 in May 3 to $188 by May 11. AAPL even hit a new 52-week high of $190.37 on May 10.

I was correct to claim that the $100 billion stock repurchase plan of Apple was aphrodisiac to long-term value investors like Warren Buffett. Warren Buffett or his Berkshire Hathaway obviously suspected prior to the Q2 FY 2018 earnings report that Apple will allocate a massive portion of its cash from abroad for stock buybacks. Apple only announced its $100 billion share buyback program after it did its Q2 earnings report last May 1.

I do not have any real evidence but Berkshire Hathaway bought 75 million AAPL shares in the first quarter of this year because it already got a hint from Apple’s management that it will allocate $100 million for share buybacks. Buffett has always been in love with the value presented by share buybacks.

Apple Has To Buy Back Loyalty of Disgruntled Mac Mini And iPad Users

I now would like to discuss the value in Apple upgrading its long-disregarded products. I am sure Mr. Buffett will agree that there are long-term benefits to fulfilling the needs of long-time Apple Mac Mini and iPad Mini customers. There’s long-term reward in buying back the loyalty and spending power of frustrated Mac Mini and iPad Mini users who bought other brands because Apple is very tardy in upgrading its small form Mac computer and iOS tablet. The last update to the Mac Mini was in 2014. The iPad Mini 4 was released in 2015. These two products obviously were discarded to the low priority list of Apple.

The Importance of the Mac Mini

The late Steve Jobs himself was the proud presenter of the first Mac Mini small form factor Mac computer in 2005. Jobs called it a very tiny but robust computer. My takeaway was the Mac Mini was Mr. Jobs’ effort to cater to people who can’t afford an iMac or Mac Pro.

It was also a clever way to persuade Windows loyalists to buy a Mac computer that can work with any third-party peripherals. Apple offered the first version of the Mac Mini for just $499. It was a successful marketing strategy in converting many Windows users to switch to the Mac system.

The bottom line is it was Apple’s Mac Mini design that inspired Intel (INTC) to create its Next Unit of Computing [NUC] reference design for tiny Windows/Linux computers. Unfortunately, the death of Steve Jobs made the Mac Mini a non-priority product under Tim Cook. This is the reason why the Mac Mini’s development is now far behind its Windows NUC counterparts.

I used to own an x86 Mac Mini 2006 version but it died from overheating due to its long years of service as a video & photo editing workstation. I still have a 27-inch iMac 2007 version that still works but it is currently in unused status along with my electric guitar. My point is Apple is slow in updating its Mac products compared to its Windows PC rival companies.

Frustrated Mac Mini customers found better small form factor computers from Windows-centric manufacturers. It was also easy for me to create a cheap hackintosh Mac OS X 10.7.5 using a $300 NUC from Gigabyte. Other graphic artists I know made Mac OS X Sierra hackintosh computers from sub-$500 NUC computers.

There are millions like me who will only buy a Mac Mini again if Apple makes a 2018 or 2019 upgrade to its 2014 Mac Mini. Apple can make an entry-level and high-margin Mac Mini models now that can appeal to 100 million PC gamers, CAD (Computer Aided Design) artists, video editors, content creators, game developers, and web designers/graphic designers.

Intel’s Kaby Lake G Core i7 and Core i5 has on-package Radeon RX Vega M GPUs (Graphics Processing Units). This Intel design can match the graphics performance of a GTX 1060 GPU from Nvidia (NVDA). Add 16GB of DDR4 RAM and a $1,199 Mac Mini can already be a decent graphics workstation machine or a gaming PC.

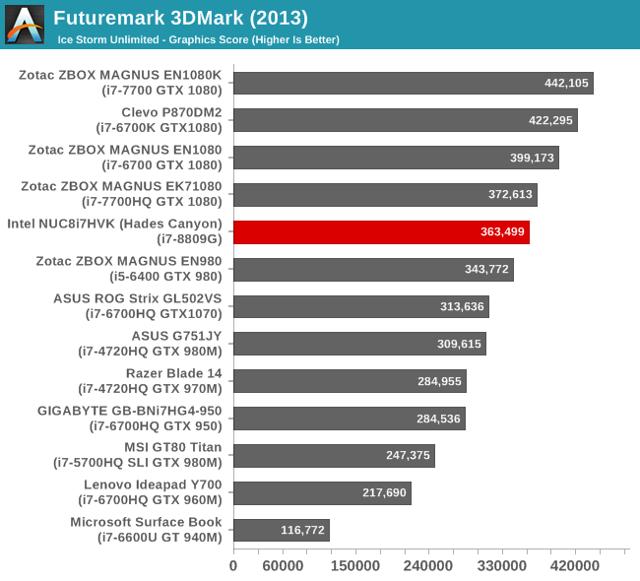

A Mac Mini that has Kaby Lake G Core i7 can match or even outperform Intel’s Hades Canyon design. The Hades Canyon tiny computer scored 363,499 under the Ice Storm Unlimited Graphics test of FutureMark 2013. The chart below also illustrates how a Kaby Lake G-equipped Mac Mini could also be a decent CAD workflow/graphics design workstation.

(Source: AnandTech)

Sad but true, there are millions more creative industry professionals who would have stayed on the Mac platform if only Apple did not forget the development of the Mac Mini computer. The stiff global competition for graphic design, CAD layouts, and game developments projects made creative professionals and content creators be more cost-conscious. It is really hard to justify investing in $3K iMacs or $5 Mac Pro machines when contractual website development or UI/UX design jobs only offer 20 to 30% operating margins.

I sold a $3.5 Mac Pro before because it was too pricey a machine for doing $5 logos, $40 wedding video editing projects, and $30 wedding album Photoshop layout jobs. Apple’s Mac business doesn’t have to cater to mid-tier and high-end models only. The sub-$700 Mac Mini is an entry-level machine that can appeal to a lot of gamers and creative professionals.

The iPad Mini Is Apple’s Perfect Mobile Gaming Device

I will buy 750 more AAPL share if Apple also updates a new version of the iPad Mini 4. The 8-inch design of this tablet makes it the perfect mobile gaming machine. Apple needs to improve the cooling system of the iPad Mini and it can be the best mobile gaming device on the planet today. I also overheated an iPad Mini 4’s motherboard from excessive gaming (4 to 8 hours every day of continuous playtime). Mobile Legends, Arena of Valor, Injustice 2 were all my favorite overheating-inducing iOS games.

My point is that Apple can reduce costs of replacing under-warranty damaged iPhones. Excessive gaming is usually the culprit why less than 1 year old iPhones go kaput. The iPad Mini 4 was a great gaming device that will not overheat if you do not play it continuously for 6 hours. Older gamers (35 years old and above) also have weaker eyesight that needs bigger-screen devices to play comfortably.

By keeping the iPad Mini updated with the latest CPU/GPU chips and advanced cooling systems, Apple has a durable/reliable device for serious mobile gamers.

A $249.99 iPad Mini 5 with A10X Fusion chip can be the best mobile gaming gadget. The top-grossing Fortnite and PUBG Mobile iOS Battle Royale games are obviously suited to larger devices like the 8-inch iPad Mini. The 4.7-inch display of an iPhone is just too small to see and shoot fast-running opponents.

Apple should also take into account that the tablet is an important platform that generates $13.9 billion in gaming revenue.

(Source: Newzoo)

Conclusion

Apple must never disregard the potential long-term contribution of the Mac Mini and iPad Mini. These entry-level products can actually enable their owners to earn more money so they afford to buy flagship products like the Mac Pro and iPad Pro.

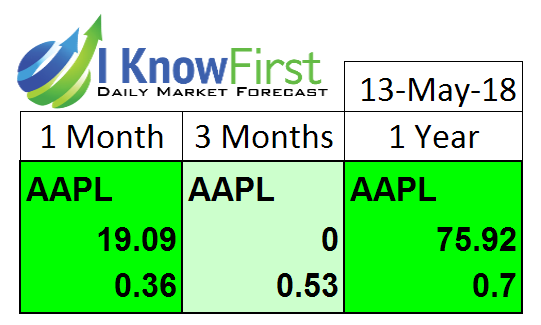

Its bullish one-year market trend forecast score backs my buy rating for AAPL. I Know First has a high 0.7 predictability score on the one-year forecast tab for AAPL. It means I Know First’s stock-picking algorithm has an excellent history of correctly predicting the 12-month market performance of Apple’s stock.

Past I Know First Success With Apple

I Know First has been bullish on AAPL shares in past forecasts. On May 21, 2017, I know First Analyst wrote about AAPL. Since then, AAPL shares have gained 23.20%. See chart below.

This bullish forecast for AAPL was sent to I Know First subscribers on May 21, 2017.

To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.