Menu

At the time of this writing, Apple stock is up by 42.37% year-to-date, crushing the S&P 500’s 11% gain and was considering as the most traded stock in 2014. Considering the company’s size, the gain is quite impressive. Apart from being the most-traded stock, Apple was also a favorite among retail investors when it comes to buying and holding a stock.

This Best Tech Stocks forecast is designed for investors and analysts who need predictions of the best performing stocks for the whole Technology Industry. It includes 20 stocks with bullish and bearish signals and indicates the best tech stocks to buy:

Package Name: Tech Stocks

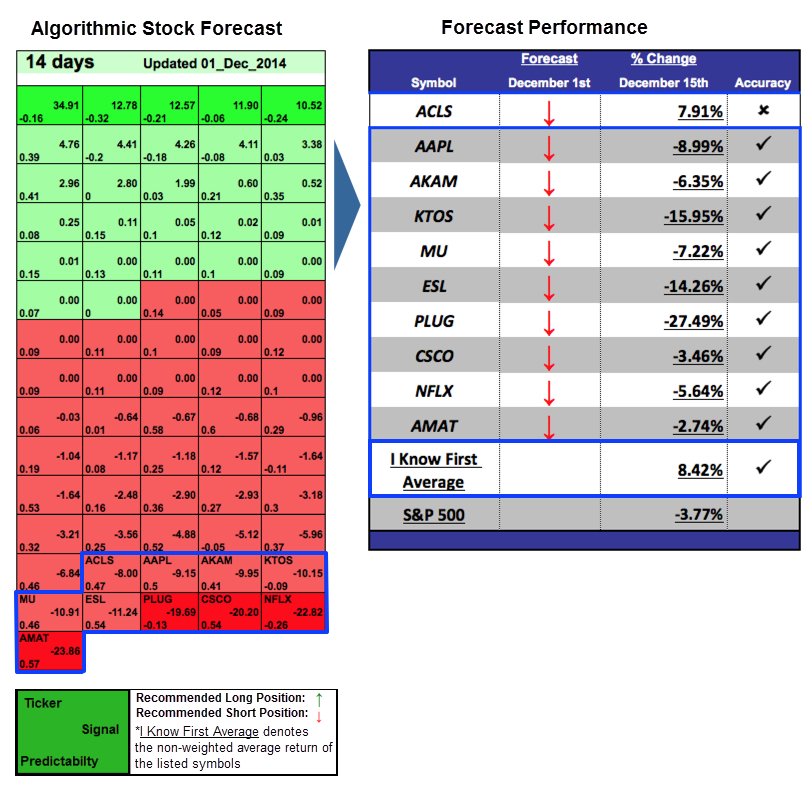

Recommended Positions: Short Forecast Length: 14 Days (12/1/14 – 12/15/14)

Forecast Length: 14 Days (12/1/14 – 12/15/14)

I Know First Average: 8.42%

Get the “Top Tech Stocks” Package.

This Best Tech Stocks forecast is designed for investors and analysts who need predictions of the best performing stocks for the whole Technology Industry. It includes 20 stocks with bullish and bearish signals and indicates the best tech stocks to buy:

Package Name: Tech Stocks

Recommended Positions: Long Forecast Length: 1 Year (12/8/13 – 12/8/14)

Forecast Length: 1 Year (12/8/13 – 12/8/14)

I Know First Average: 34.90%

Get the “Top Tech Stocks” Package.

This Best Tech Stocks forecast is designed for investors and analysts who need predictions of the best performing stocks for the whole Technology Industry. It includes 20 stocks with bullish and bearish signals and indicates the best tech stocks to buy:

Package Name: Tech Stocks

Recommended Positions: Long Forecast Length: 3 months (9/3/14 – 12/3/14)

Forecast Length: 3 months (9/3/14 – 12/3/14)

I Know First Average: 10.64%

Get the “Top Tech Stocks” Package.

Today, Apple and IBM announced plans for an exclusive partnership in the mobile arena. IBM will begin selling iOS devices to its corporate customers and will also develop new applications from the ground up made specifically for the iPad and iPhone.

I Know First-Daily Market Forecast, does not provide personal investment or financial advice to individuals, or act as personal financial, legal, or institutional investment advisors, or individually advocate the purchase or sale of any security or investment or the use of any particular financial strategy. All investing, stock forecasts and investment strategies include the risk of loss for some or even all of your capital. Before pursuing any financial strategies discussed on this website, you should always consult with a licensed financial advisor.

I Know First-Daily Market Forecast, does not provide personal investment or financial advice to individuals, or act as personal financial, legal, or institutional investment advisors, or individually advocate the purchase or sale of any security or investment or the use of any particular financial strategy. All investing, stock forecasts and investment strategies include the risk of loss for some or even all of your capital. Before pursuing any financial strategies discussed on this website, you should always consult with a licensed financial advisor.