Apple Stock Outlook For 2019: SWOT Analysis + I Know First Forecast For AAPL

The infamous Apple logo

Apple (NASDAQ:AAPL) has come a long way over the past few years. As it has doubled its stock price since summer 2016 and become the first trillion dollar company earlier this year, it has also seen some dips and is currently below the price it was at a year ago.

Apple is now down 33% from it’s all time high of 233.47 and has dropped below the trillion dollar mark once again. Apple’s most recent tumble has left the company at a new 2018 low ~$150 on December 21 causing market cap to drop below $700 billion for the first time in nearly 2 years. So what’s next for the company for the next year? Will the stock price continue to slump as it has for the tail end of 2018? Or will it bounce back for another record breaking year? In this article, we will take a look at Apple’s strengths, weaknesses, opportunities, and threats in order to determine the tech giant’s future potential.

SWOT Analysis

Strengths

Apple has many strengths that have helped it stay on top of the phone and computer market for years. It’s simple and easy to use iOS phone software compatibility with its macOS computer software has allowed consumers to maintain seamless connections between their phones and computers. This has contributed to the large brand loyalty customers feels towards Apple. Many iPhone users have used the flagship phone for years and do not plan on switching anytime soon.

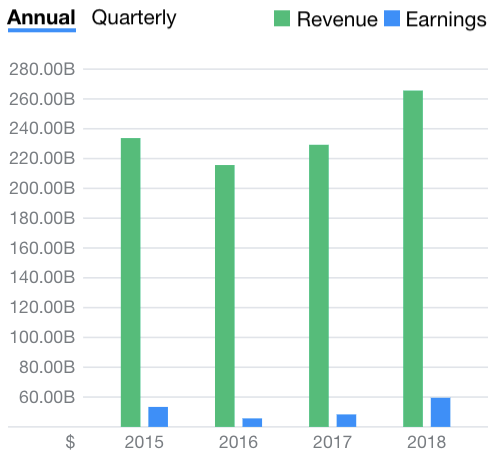

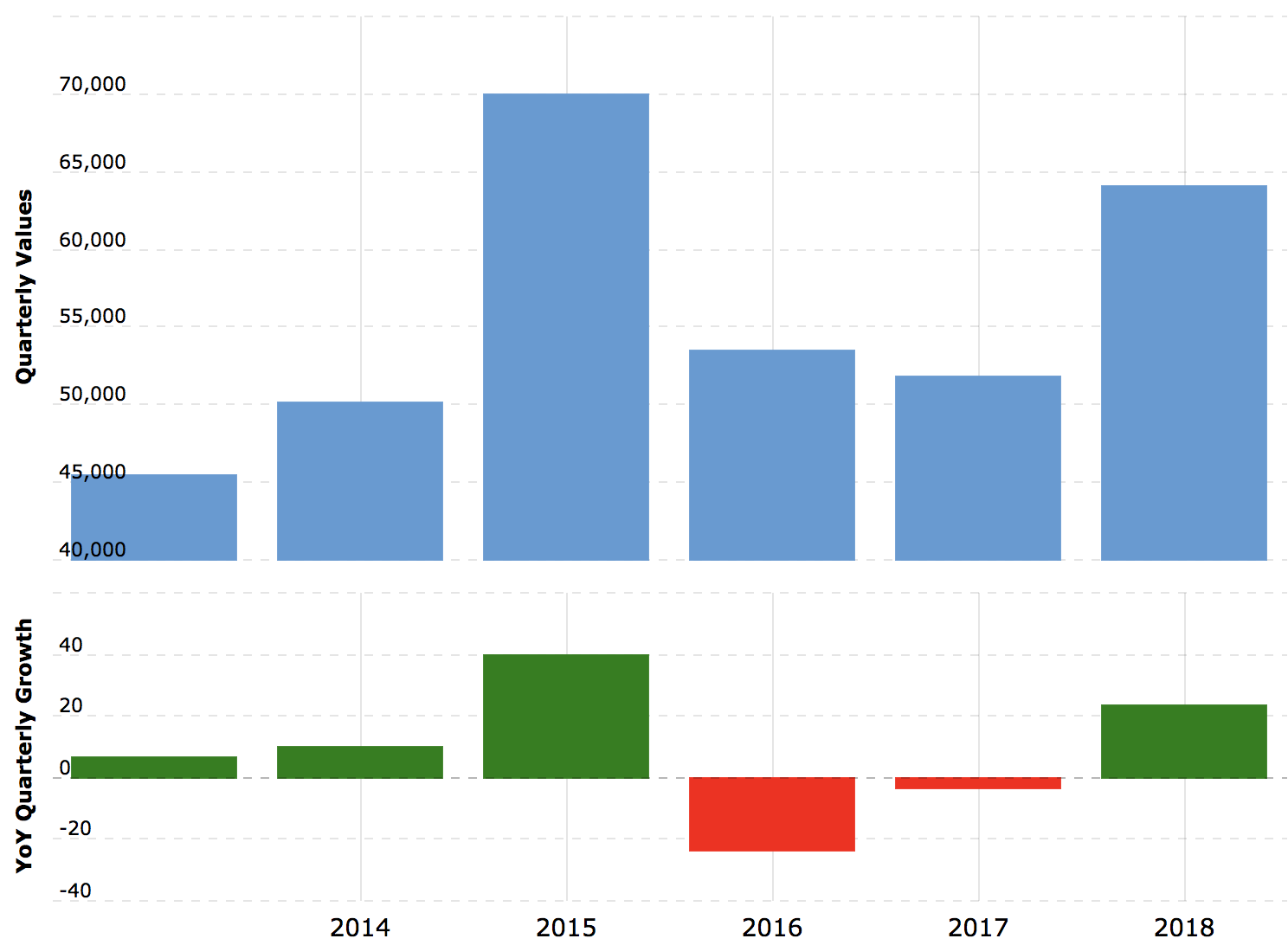

Moreover, Apple has boasted strong financials over the past years with strong quarterly reports. While some investors were not necessarily thrilled with the company’s latest Q4 earnings report, there were still many impressive metrics such as a 20% YoY increase in revenue to $62.9 billion. This translated to an extraordinary 41% YoY increase in earnings per share of $2.91. These high percentages resonate more with those of a startup than the multibillion dollar company Apple has become.

Source: Yahoo Finance

These high revenues have given the company high cash flow it can invest as it chooses. The company has put a large focus on research and development of its current products as well as new ventures. For example, the company releases new iterations of its phones, computers, and watches yearly. On top of that, the company has been working on new applications of its technology such as self-driving cars. In the past, Apple has created innovative products that have helped attract and maintain customers.

Apple Annual Free Cash Flow (Source: MacroTrends)

Despite being a multibillion dollar company, Apple still have a relatively fair valuation. The company’s Price/Earnings Ratio is cheaper than the industry average which sits around 20. This is also very valid considering it also has a very reasonable forward P/E of 11.85. Additionally, Apple’s earnings growth doesn’t seem to be stopping. Over the past 5 years, EPS growth has been around 15%. Over the next 2 years, EPS is expected to grow by a slightly lower, but still significant 11.10%.

Weaknesses

While Apple did have a strong start to the year, it struggled in the final quarter of the year. Despite announcing three new iPhone models in September, the company did not meet expectations for unit sales. While this would have been disheartening, but not necessarily worrisome on its own, Apple also announced it would no longer release metrics for hardware unit sales. To many investors, this implied a slowdown of sales and potentially a dip into negatives.

One of the most unique features of the iPhone XR is the new color ways available. Although some of these colors were also available for Apple’s last budget phone, the iPhone 5C (Source: Apple)

So why exactly have iPhone sales been down? With improvements in the technology within smartphones, they now last longer and consumers do not necessarily need one every year or two. Additionally, the latest iteration of iPhones were extremely similar to the previous generation, leading few people with newer phones to upgrade. In the past, the new features of the most recent iPhone might still incentivize those with functioning phones to take the plunge for the news phone, now only those who are in need of new phone will invest. Additionally, the high price of the iPhone XS and iPhone XS Max may be a pinnacle for Apple’s pricing power. Even the company’s cheaper option, the iPhone XR, sells for a premium of $749. The higher prices for fewer new features has led consumers to use their phones for longer and hold off on upgrading, decreasing hardware sales.

On January 2, Apple released a press release outlining a revised lower guidance for the upcoming quarter. This sent the Apple stock tumbling as investors began worrying about these lower earnings. Apple cited four primary reasons for the decreased expectations: launch timing, foreign exchange conversions, supply constraints, and difficulty in emerging markets. The most significant weakness to Apple is the lack of revenue from iPhones which the company attributes to the timing of its launch. Because of the delay in the iPhone X, many of the orders were fulfilled in Q1 2018 whereas the majority of iPhone sales were fulfilled in Q4 2018 for the iPhone XS, iPhone XS Max, and iPhone XR. This in combination with supply constraints urged Apple to warn its investors of lower potential revenue for the first quarter of 2019.

Opportunities

While iPhones still represent Apple’s core business, Apple has been diversifying its revenue by focusing on its services. While buying an iPhone or other Apple hardware product happens at most once a year, services can be purchased at anytime with higher frequency. Apple’s Services division is composed of many different services ranging from AppleCare, Apple Pay, Apple Music, and more. In its most recent quarter, Services revenue increased 17% YoY to nearly $10 billion. If Apple continues to focus on the Services market, it can reap large profits.

Apple also recently teamed up with Amazon to form a lucrative new partnership. Amazon will now be a direct reseller of Apple iPhones and iPads. This should help to boost hardware sales and sets the stage for future partnerships with Amazon which should prove profitable for Apple. This partnership also allows Apple the chance to capitalize on another opportunity: holiday sales. The holiday season has high potential to increase hardware sales.

Another potential, but less likely partnership may be with Tesla. Many analysts have noted that the companies similar emphasis on seamless software and sleek hardware could lead to either an acquisition or partnership. While there has been no indication from either company that this is in the works, it would be logical considering Apple’s work on self driving cars and Tesla’s need for free cash flow.

Apple has struggled in the past with developing markets such as in India. The expensive iPhone has not had the massive success it has in other countries because of many lower price alternatives from competitors. Additionally, high tariffs have made the phones come at an even higher premium. Apple began combatting this by starting to assemble iPhones such as the SE and 6S in 2017 through Wistron’s local unit in Bengaluru. Apple has now struck a deal with Foxconn to being manufacturing its newer iPhones such as the iPhone X in the beginning of 2019. Until now the company has only sold is lower end models, so the introduction of new premium phones will hopefully grow Apple’s prominence in the country. This partnership has massive potential to help Apple gain market share in the huge Indian phone market.

Threats

Source: Pixabay

In December, the US market officially entered bear territory, just like Apple itself. Many stocks are struggling in December, one of the usually most profitable months for companies. As one of the biggest stocks in the US stock market, Apple can be affected by general market sentiment and trends like this December dip. With many analysts wary of an oncoming recession, Apple could suffer from no fault of its own.

Another potential threat Apple faces is an escalating US-China trade war. Just like the entire technology sector, Apple is susceptible to impacts from tariffs. Additionally, Apple faces pressure to move production to US which would lead to higher costs for Apple. Meanwhile, China has proposed various policies from closing its markets which would affect many Apple suppliers. On top of this, Apple is currently appealing an iPhone sales ban in China and Germany on older iPhone models over patent infringements of Qualcomm. A Chinese court has banned imports and sales of iPhones comprising approximately 10-15% of Apple’s China sales. However, Apple will continue selling its iPhone 7 and 8 models on the website while the decision is appealed.

The trade war is not the only difficulty Apple is facing in regards to international expansion. Another major player in Apple’s lower revenue guidance was difficulty in emerging markets and significantly lower iPhone sales in China. As a whole, China’s economy has been slowing down since the middle of 2018. This economic slowdown was only exacerbated by trade tensions leading to a large contraction in the smartphone market that affected Apple and created a revenue shortfall. Apple also overestimated the number of upgrades in these emerging markets which is a result of a strong US dollar, fewer subsidies, and phones now function at a high capacity for much longer than they used to. Apple is already taking action to minimize the impact of these threats in the future.

Analyst Recommendations

Currently, the majority of analysts have a bullish outlook for AAPL. Of the 42 analysts polled by Yahoo Finance, 31 rate Apple stock as a Buy with 11 of these as Strong Buy. Only 11 of the analysts give Apple a neutral rating.

Conclusion

Despite lowered earnings expectations, which has been a very bearish signal for many investors, Apple still has potential in the new year. While Apple cannot control the macroeconomic environment that has led to this decreased guidance, the company is already combating these with new programs. For example, Apple is now incentivizing customers to upgrade their iPhone by offering larger trade in values for older models. Additionally, which iPhone sales have suffered, the largest number of iPhones are being used daily which provides a large market for Apple’s services and also exemplifies the loyalty of Apple users. The price drop that resulted from Apple’s press release now provides an even more valuable opportunity to buy into the multibillion dollar company.

While Apple does have some weaknesses to work on and threats to combat, the company has many strengths and opportunities it is building on while should outweigh the downside. That being said, as the economy sinks into bearish territory and trade war tensions continue building, the market as a whole including Apple, will probably not see any major gains. Over the long run though, Apple should bounce back. As it diversifies its revenue by taking advantage of Apple Services, the offset of decreased hardware sales will affect earnings less. Additionally, with a track record of new innovation, Apple’s next line of phones should be more unique. Moreover, no one knows what other products are in development. Based on this, Apple should be back in winning territory by the end of 2019.

I Know First 2019 Bullish Forecast For Apple

The I Know First machine learning algorithm currently has a positive outlook for AAPL. While the stock is bullish over all time horizons, it is most bullish for the 1 year period with a signal of 310.36 and predictability indicator of .85.

Past I Know First Success With Apple Stock Forecasts

Past I Know First Success With Apple Stock Forecasts

A bit over a year ago, the I Know First algorithm gave a bullish long term outlook for AAPL which was included in a premium article on how the trillion dollar app economy is boosting Apple. The prediction was bearish in the short term, but saw a positive upside over the 1 year time horizon with a signal of 116.66 and a predictability indicator of .62. In accordance with the algorithm, Apple has grown nearly 45% since then.