This article was written by Ave New, a financial analyst at I Know First. He graduated from the Royal Melbourne Institute of Technology (RMIT) with a B.A. Business (Marketing).

Apple Stock Prediction

Summary

- Increase Service Revenue (Apple Pay)

- Reclaiming top spot in smartphone industry

- Share buybacks & dividends

- I Know First’s algorithm maintains a bullish forecast on AAPL shares

Background

Apple Inc. (AAPL) is a multinational corporation that design and manufacture consumer electronics such as mobile communication devices, personal computers, and portable music players. Apple also sell a variety of software, services and peripherals. The company sells its products worldwide through online stores, retail stores and third party wholesalers and retailers.

Apple’s diverse range of products means they do not operate in one industry segment, thus they have many different competitors. In the smartphone industry, their main rival is Samsung or other companies that produce android phones. In the computer operating system market, Apple’s biggest competitors are Microsoft and IBM.

The service industry has a lot of sub segments, consequently Apple competes with companies such as Spotify, PayPal, Google, Netflix and Amazon.

Music streaming, Mobile payment services, Exclusive Video content and cloud storage are all services Apple dabble in.

Market Share

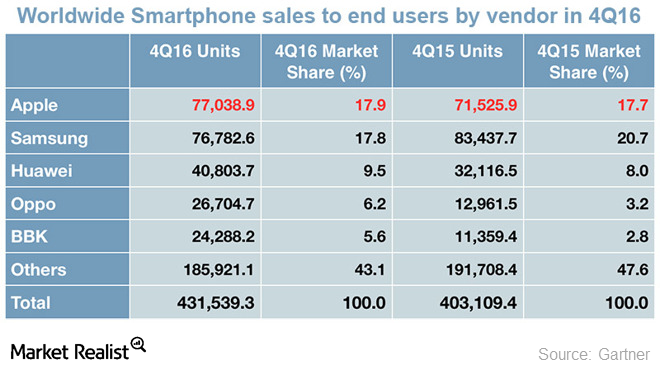

In the smartphone industry, Apple reclaimed the top spot from Samsung. With an estimated 431 million units sold, 77 million in 4Q16, an increase of 7%, above the expected number. Apple’s iOS accounted for 17.9% of the market. Up against the Android OS, which accounts for a whopping 81.7% of the market. As shown in the chart below.

Source: Market Realist

Important to note is the fact that the iPhone generated almost 70% of revenues for Apple in fiscal 1Q17. In part, due to the average selling price of phones growing from $619 in the previous September quarter to $695. Other positives to come out of Apple’s earnings was Mac revenue’s rising by 7% to $7.2 billion, following a 17% decrease in the previous quarter. Probably reflective of the $78 increase incurred on the average selling price (up to $1348).

Services Industry

In fiscal 2016, Apple generated $25 Billion in revenue through its Services Business. Apple hopes to increase that figure to an ambitious $50 Billion in 2020.

Nonetheless, they are on track with the segment emergent as Apple’s fastest growing. Increasing by 18% to $7.2 Billion, making up 9% of total revenue for 1Q17. App store sales went up 43% over the first 13 weeks of the quarter, aiding the growth.

Apple’s Services business includes products such as iTunes, iCloud, Apple Pay and Apple Music.

Crucial to achieving the goal of $50 Billion in Revenue is the success of the Apple Pay service. Apple transactions have already risen by more than 500% in the 1Q17. Jennifer Bailey, the VP of Apple’s (AAPL) Apple Pay, stated that more than 35% of US retailers already accept Apple pay.

An estimated adoption rate of 35%, equating to 4 million locations, with a further anticipated adoption rate of 67% the following year.

In October 2016, Apple pay saw some immediate success with launches in Japan, New Zealand and Russia.

Conversely, despite all the positive data, Apple have a lot of ground work to make up on giants such as PayPal (PYPL), Google (Android Pay) and Ali Baba’s (BABA) Ant Financial Services Group to name a few.

Buybacks and Dividends

Majority of tech companies classically keep their cash outside of the United States to reduce/avoid tax burdens. Apple is no exception, holding $246 billion in cash overseas.

On February 16th, 2017, Apple paid $3.1 billion in dividends to its shareholders. Over the last four quarters, $12 million was paid from Apple to its stockholders in dividends. Over the same period, Apple repurchased $31 billion in shares. The vigorous capital return helped to improve shareholder value as well as earnings per share (EPS).

Out of the top ten companies that spent money on buybacks, three belonged to the tech sector. Apple, Microsoft (MSFT) and Oracle (ORCL) with Apple spending the most. In 2012, Apple created a Capital Return program, with $201 billion of a possible $250 billion already being returned. Apple intends to have completed the program by the end of March 2018.

Our very own

On May 23rd, 2016, I Know First’s very own Senior Analyst Motek Moyen wrote an article about Warren Buffet and his recent purchase of Apple stocks. Motek also advised our readers to add AAPL stock to their portfolios, predicting the iPhone would deliver strong sales. All these recommendations were in line with the positive I Know First algorithmic forecasts.

Fast forward 10 months, Warren Buffet’s Berkshire Hathaway added an additional 76 million Apple shares to its holdings. Translating to a monster holding $7.7 billion worth of stock and owning more than 1% of Apple stock. In 2017 alone, Berkshire Hathaway has already made more than $1.1 billion off the stock. A significantly higher figure than the $400 odd million they would have made had Buffet not upped their holding.

I Know First Algorithmic Forecast

I Know First’s algorithm maintains a bullish forecast on AAPL shares in the long-term. For the one-year time frame, the algorithm has a 102.08 signal strength and a 0.57 predictability indicator.

I Know First Algorithm Heatmap Explanation

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

Conclusion

Consumers love to speculate, with Apple reportedly planning to launch the iPhone 8 with an organic light-emitting diode (OLED) display, all glass body, finger-printless, wireless charging, along with other features that are unknown. Based on the strong sales of the previous iPhone, it’d be safe to assume there would high demand that accompanies the release of their next phone. Pairing strong iPhone sales with robust performance in their other industry segments, specifically the Service industry. Given these factors, I Know First maintains its bullish forecast for Apple.

Past I Know First Success With Apple Inc.

I Know First has been bullish on AAPL shares in past forecasts. On May 23rd, 2016, I know First Analyst wrote about Apple Stock. Since then, Apple shares have risen by more than 45%. As seen below.

This forecast was sent to current I Know First subscribers on May 23rd, 2016. To subscribe today click here.