AAPL News

Apple Inc. (AAPL) held its “Spring Forward” event on Monday, March 9th. The company released new details of its long-awaited Apple Watch at the event and was dubbed an Apple Watch event by many analysts. But other new products also garnered much fanfare, and these products set up Apple to increase its market value further.

The headliner of the event was the Apple Watch, and it did not disappoint. Apple CEO Tim Cook announced that the wearable device will come in two different sizes and three different models. The Apple Watch Sport will start at $349 for the 38mm version, while the 42mm version will be $349. The Apple Watch will range from $549 to $1099 depending of the wrist band, while the Apple Watch Edition will start at $10,000.

The varying price range shows Apple hopes to win over both the high and low end of the market with its new device. Basically, it hopes to be the best device someone can buy for either $349 compared to other low-end watchmakers, or compared to luxury brands like Rolex for up to $17,000. And they might be able to pull it off because of its usefulness. Simply put, the Apple Watch will make using the iPhone easier and simpler for consumers, making the technology nearly invisible.

Users will be able to make phone calls, read and send messages, and monitor their own health status, along with a large range of other functions, with their wearable device, saving them time and effort. The ability to hail an Uber at any time simply using your watch may not sound that incredible, but people might not be able to live without it after getting used to the effortless practice. The same can be said for many of the watches uses.

A perfect example will be Apple Pay, which Apple hopes will be helped by the use of the Apple Watch. The payment service is now accepted at 700,000 merchant locations, which is nearly three times the number of merchant locations it was accepted in just three months ago. Already having dubbed 2015 the year of Apple Pay, Cook affirmed this declaration at the event, as it fits into Apple’s attempt to make everyday tasks easier and simpler using its technology.

The Apple Watch makes using Apple Pay even easier than with the iPhone, as it only needs to be within a certain distance of a sensor to work. Users will no longer have to take out their phone and use a fingerprint, and it is even more speedy, convenient, and secure than before. The Apple Watch also opens up Apple Pay to earlier versions of the iPhone, not just for the iPhone 6. The seamless and easy use of this technology will assist Apple take a larger part in its consumers’ lives while not being visible.

The Apple Watch was not the only new technology revealed at the event, and the MacBook was a huge hit. Apple debuted its thinnest and lightest MacBook today, which is 24% thinner than the MacBook Air. Prices for this device start at $1,299, and some of the features are pretty remarkable. It has a 12-inch retina display and a new Force Touch touchpad that will be able to tell the difference between light taps and strong presses. The most interesting feature is its USB-C connector that supports five connection standards: USB data transfer, power, DisplayPort, HDMI, and VGA.

While the MacBook rightfully garnered lots of attention, Apple’s forays into Apple TV and Apple CarPlay are what are so promising for the company. Cook announced that every major car brand has committed to delivering CarPlay, noting that 40 different models will ship with the software this year. The in-car entertainment system is designed in house by Apple, providing a smoother, more familiar experience. This will also add to Apple’s presence in its users’ lives, adding another screen for Apple. It will also act as a precursor to Apple’s own car, which it is rumored to be working on.

Another product that Apple has been rumored to be working on is its own TV. Apple already has the Apple TV, and it announced a partnership with HBO. Customers will be able to stream the service without a cable subscription for the first time using the device, making it cheaper. These developments are important for Apple, who hopes to increase its presence in consumers’ lives.

Increasing its presence through the Apple Watch, Apple TV, and Apple Car could dramatically expand the reach of its ecosystem, decreasing the company’s reliance on sales of the iPhone. Doing so could cause the company to reach the $1 trillion marker valuation that is the company’s next target for analysts, after reaching $700 million and maintaining its value above it for weeks now. While this strategy has been rumored before, it now seems apparent that Apple hopes to be even more present in people’s lives while not being thought of, making the products indispensible to its users’ lifestyle.

Algorithmic Analysis

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The algorithm has more data to forecast within the long term and, naturally, outputs a more accurate predication in that time frame. Having said that, intraday traders, along with short-term players, will also benefit by taking the algorithmic perspective into consideration.

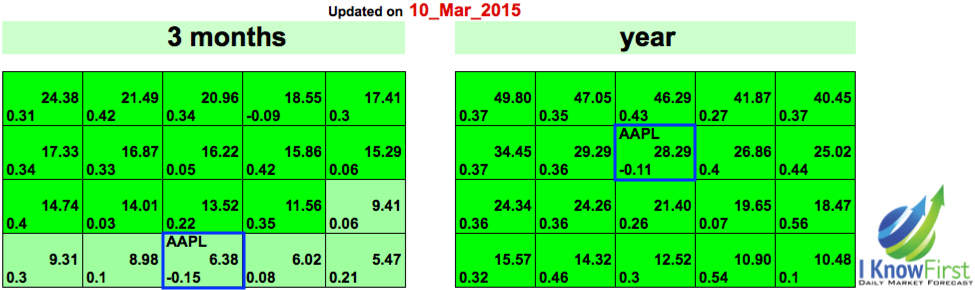

The I Know First algorithm was able to correctly predict the behavior of Apple’s stock over the last year. Figure 1 is an I Know First algorithm prediction made on February 21st, 2014. The self-learning algorithm uses artificial inelegance, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

In this forecast, Apple had a signal strength of 1.83 and a predictability indicator of 0.3 for the one-year time horizon. In accordance with the algorithm’s prediction, the stock price increased 73.89% over that time.

Having demonstrated how I Know First’s algorithm was able to correctly predict the movement of Apple’s stock price earlier in the article, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company. Figure 2 includes the three-month and one-year forecasts for Apple from March 10th, 2015. In both forecasts, Apple has a positive signal, indicating the algorithm is bullish for the stock.