Financial Results For Fiscal 2015 First Quarter

As investors by now surely know, Apple Inc. (Nasdaq: AAPL) released its most recent earnings report on January 27th, 2015 for the fiscal quarter ending December 27th, 2014, and it blew the doors off of analysts’ expectation. The company sold 74.5 million iPhones during the holiday quarter, which is astonishing when you consider this means it sold 34,000 iPhones every hour over that time. Record revenue from iPhone and Mac sales, as well as a record performance from the Apple App Store, led to the company’s highest ever revenue of close to $75 billion. Even more impressive, the company posted net profits of $18 billion, a record for any publicly traded company. Shares rose about 5% in after hour trading after the positive financial news.

fiscal quarter ending December 27th, 2014, and it blew the doors off of analysts’ expectation. The company sold 74.5 million iPhones during the holiday quarter, which is astonishing when you consider this means it sold 34,000 iPhones every hour over that time. Record revenue from iPhone and Mac sales, as well as a record performance from the Apple App Store, led to the company’s highest ever revenue of close to $75 billion. Even more impressive, the company posted net profits of $18 billion, a record for any publicly traded company. Shares rose about 5% in after hour trading after the positive financial news.

Now that the financial results have been released and pored over by analysts, there is a divergence of opinion on how the stock will perform during the rest of 2015. Nearly a dozen research firms raised their price targets on Apple after the company’s impressive report. But some analysts believe that Apple will face significant challenges in the coming year, citing such arguments as the stock is now too expensive or that slowing smartphone growth, which Apple is overly reliant on, will harm the company’s margins. However, Apple is well positioned for continued growth in 2015 because of its diverse ecosystem of product offerings and its success in China. Furthermore, the company is still currently undervalued, even with its stock price having climbed over 60% since the same time last year.

A Fundamental Argument For Why Apple Is Still Bullish

Some analysts believe that Apple is becoming too reliant on the iPhone, which accounted for 69% of the company’s revenues last year. They cite how growth in the smartphone market is slowing down, and that prices will fall, too. These analysts fail to understand that Apple does not market individual products, but an experience. The company’s goal is for its products to work seamlessly together, taking out the difficult part in technology.

The company’s products, including its iPhones, iPads, and Macs, are all interlinked and running on its Apple iOS software. Apple is introducing and emphasizing a variety of new products that will strengthen this ecosystem of related products, including its Apple Watch and Apple Pay. During the earnings call, Apple’s CEO Tim Cook revealed that the Apple Watch would be released in April, in line with the company’s previous guidance that it would be available in early 2015.

Apple has already released Apple Pay, and Cook reported that about 750 banks and credit cards have already signed on to bring the mobile wallet to its customers. It has already become the most popular payment method of its kind, making $2 out of every $3 spent on purchases using contactless payment. USA Technologies also made Apple Pay available at about 200,000 places where everyday payments happen, such as vending machines, parking meters, and Laundromats. Jim McCarthy, the global head of innovation and strategic partnerships at Visa, Inc. (NYSE: V) called it a long- term tipping point for mobile payments.

What makes Apple’s products so appealing is how effortlessly they work together and its ability to create exciting technologies that people want to buy. The wearables market has not yet taken off, even though some competitors have already released their own versions. But if anyone is capable of making a wearable fashionable, it will be Apple. Moreover, the product will work in sync with the iPhone and Apple Pay. It will even have the ability to monitor user’s health vitals and send information the user’s medical physician.

Its exciting, diversified product offering is enough to make me bullish on Apple, but it is also experiencing success in China, the world’s largest smartphone market. The company partnered with China Mobile Ltd. (OTCQB: CHLKF), the world’s largest mobile carrier, and has now become the top smartphone company in China. The big screen iPhones drove revenues in China up 70% in the previous quarter from a year earlier, and I anticipate the huge growth in the country will continue. Apple is opening five new retail stores in the country in the run-up to the Chinese New Year’s prime shopping season next month, and will have 40 stores open by 2016.

Even with the stock price above $115 per share as I write this, Apple is still actually a good value compared to other tech companies. Even with the stock price drastically increasing in the past year, the company’s price to earnings ratio, based on projected profits, is still below 15. This means it is still trading at a discount to the S&P 500 technology index, even though the company’s earnings are growing 32% faster than the average big tech stock’s. This discounted price, along with the possibility that Apple will further raise dividends in the future, something Cook does not appear hesitant to do, make Apple’s high stock price actually look appealing.

Algorithmic Analysis

While fundamentals are very important, it can be quite advantageous to also consider stocks like Apple from an algorithmic perspective. Though algorithms, like any other methods of analysis, are not definitive, they often contribute important information about a company, especially when viewed in combination with historical trends and fundamentals.

I Know First is a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. The algorithm predicts the flow of money in almost 2000 markets across a range of time frames (e.g., 3-day, 1-month, 1-year). The algorithm’s predictability becomes stronger in the 1-month, 3-month, and 1-year horizons, so it is particularly useful as a long investment tool, although it can also be used for intraday trading.

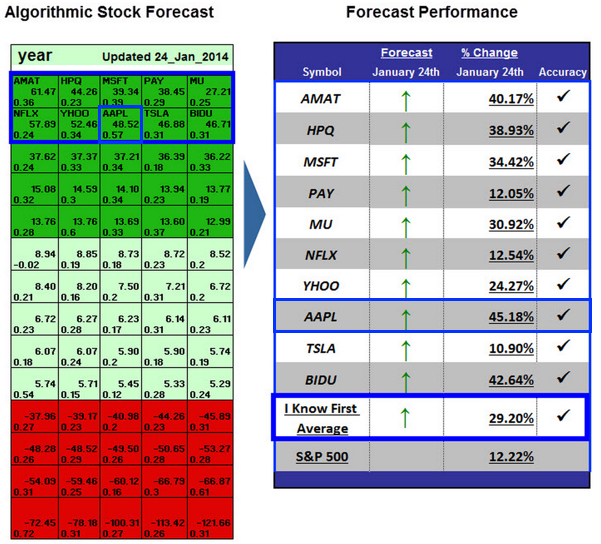

I Know First has successfully predicted Apple’s outcomes in the past. For example, in a one-year forecast running from January 24th, 2014 to January 24th, 2015, I Know First predicted that Apple would be one of the ten best stocks of the forecast; the stock held true to this prediction for a return of 45.18%. As the algorithm has had success predicting Apple’s behavior in the past, its current forecasts could be very useful for forecasting its performance in 2015.

The new 3-month and 1-year forecasts for Apple, generated by the I Know First algorithm and updated on January 29th, are shown below. Bright green signifies a highly bullish signal; light green also indicates that the forecast is bullish, but not as strongly so. Bright red, in turn, signifies a bearish forecast; correspondingly, light red indicates a bearish forecast as well, though not as negative. Each compartment contains two numbers: the strength of the signal itself (represented by the number in the middle of each box, to the right), and its predictability (found in the bottom left corner, this is the approximate level of confidence our service has in the forecast).

Conclusion

The signal strengths in these forecasts are not nearly as strong as they were in the previously shown forecast. It is important to note that the signal strength is not a predicted price or percentage, but indicates a trend. In this case, Apple is bullish, meaning investors should wait to cash in on Apple, as it has further room to grow. This goes along with the fundamental analysis, as a diversified, synchronized product portfolio, future growth in China, and a relatively low current valuation against projected earnings point to the stock price moving even higher..